Trolley Payouts Overview: Enterprise Global Payment Automation for Modern Platforms

Introduction

As digital ecosystems expand globally, payout management becomes a core operational function. Marketplaces, affiliate networks, creator platforms, SaaS businesses, and fintech companies must distribute funds securely, accurately, and compliantly across borders.

Trolley payouts refer to structured global disbursement solutions that automate large-scale payments while integrating compliance, tax documentation, and reporting into a centralized infrastructure. This guide explores how trolley payouts work and why they are essential for scalable digital platforms.

What Are Trolley Payouts?

4

The term trolley payouts is associated with the services provided by Trolley. The platform enables businesses to send payments internationally while embedding tax compliance and identity verification directly into the payout lifecycle.

Unlike consumer payment applications, trolley payouts are built specifically for high-volume business disbursement operations.

Core Components of Trolley Payouts

A trolley payouts framework typically includes four key layers:

1. Recipient Onboarding

Recipients securely provide:

- Bank account information

- Preferred currency

- Tax documentation (W-8, W-9)

- Identity verification data

Automated onboarding reduces errors and accelerates payout readiness.

2. Compliance & Risk Management

4

Before funds are released, systems may perform:

- Sanctions list checks

- Anti-money laundering validation

- Fraud detection analysis

- Audit logging

Compliance automation minimizes regulatory exposure.

3. Global Payment Execution

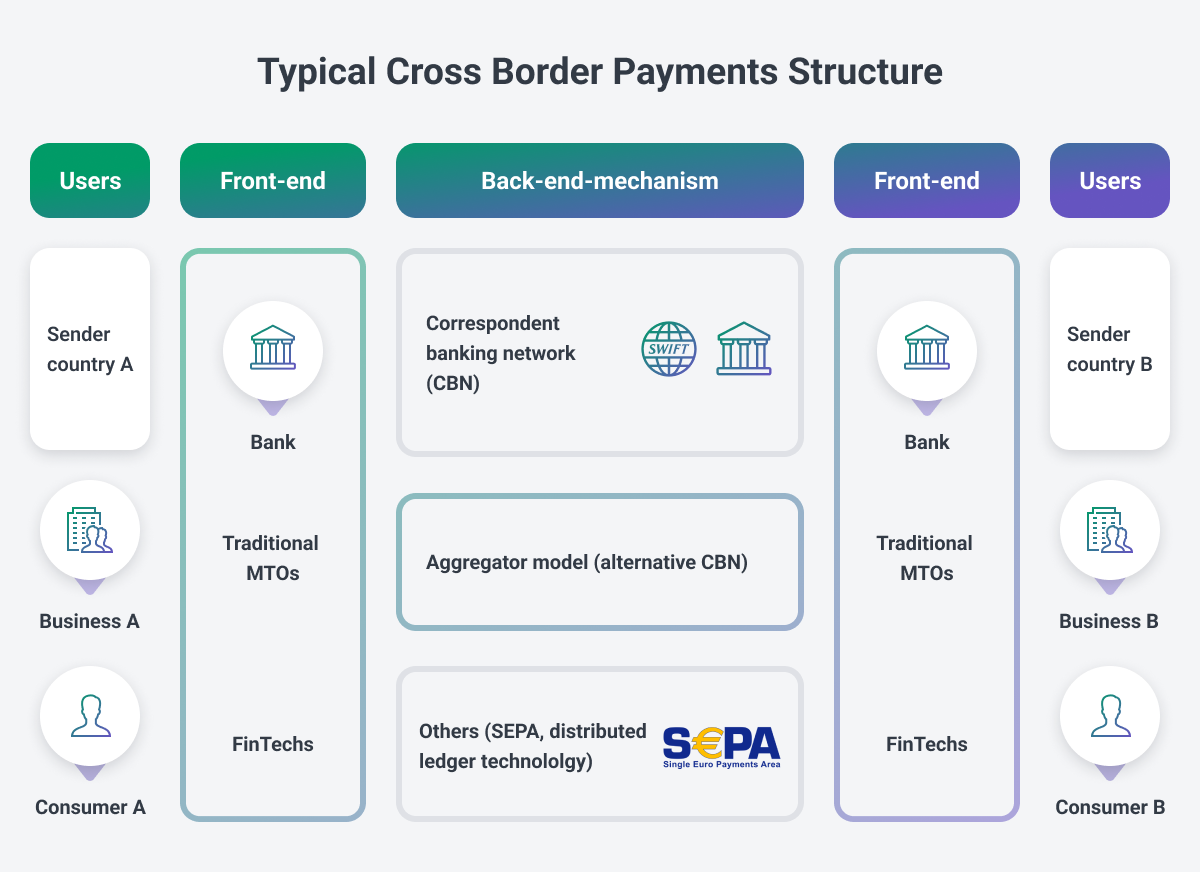

Supported payout rails often include:

- ACH (United States)

- SEPA (European Union)

- SWIFT (International transfers)

- Local banking networks

- Multi-currency settlements

Businesses can initiate:

- Bulk payout batches

- Recurring scheduled payments

- API-triggered transfers

- Manual dashboard disbursements

Automation ensures consistent payout cycles.

4. Reporting & Reconciliation

Operational oversight tools commonly provide:

- Real-time payout tracking

- Error and rejection notifications

- Exportable transaction reports

- Year-end tax documentation summaries

These tools support accounting and compliance workflows.

Multi-Currency & Cross-Border Capabilities

4

International payouts require managing:

- Currency exchange fluctuations

- Regional compliance standards

- Settlement timelines

- Foreign exchange transparency

Trolley payouts typically centralize FX management and improve cross-border transaction visibility.

Tax Documentation Automation

Tax compliance is embedded into many payout systems. Automation may support:

- Digital W-9 collection

- W-8 series forms for international recipients

- Tax identification validation

- Annual reporting exports

Integrating documentation into payout workflows reduces administrative workload.

This article is informational only and not legal or tax advice.

Security Standards

Financial infrastructure requires robust protection. Trolley payouts systems generally implement:

- Encrypted data storage

- Secure API authentication

- Role-based access controls

- Comprehensive audit trails

- Real-time monitoring alerts

Strong security measures protect sensitive financial information.

Who Uses Trolley Payouts?

Common users include:

- Online marketplaces

- Creator monetization platforms

- Affiliate marketing networks

- Gig economy services

- SaaS businesses

- Fintech startups

Any organization distributing funds at scale may benefit from trolley payouts infrastructure.

Search Intent Behind “Trolley Payouts”

Searchers using this keyword typically include:

- Business leaders researching payout infrastructure

- Developers evaluating API integration capabilities

- Recipients verifying payment sources

- Compliance professionals reviewing documentation systems

Providing structured, neutral, and educational content supports sustainable SEO performance.

Final Thoughts

Trolley payouts represent a scalable global disbursement solution designed for modern digital platforms. By integrating payment execution, compliance automation, tax documentation workflows, and API-driven scalability, trolley payouts help organizations manage international payments efficiently.

As global digital commerce continues to expand, structured payout infrastructure becomes essential for