Trolley Payouts Guide: Global Mass Payments, Compliance Automation & Scalable Infrastructure

Introduction

As online platforms grow internationally, payout management becomes a critical infrastructure layer. Marketplaces, affiliate networks, creator platforms, SaaS ecosystems, and fintech applications must distribute funds securely and compliantly across multiple countries.

Trolley payouts refer to structured global disbursement solutions that automate mass payments while integrating tax documentation, compliance screening, and reporting workflows into a centralized system. This article provides a complete, search-optimized overview of how trolley payouts work and why they matter.

What Are Trolley Payouts?

4

The term trolley payouts is commonly associated with the global payout infrastructure provided by Trolley. The system is designed for businesses that need to distribute funds internationally while maintaining regulatory compliance and operational transparency.

Unlike traditional banking systems, trolley payouts are purpose-built for high-volume, cross-border business disbursements.

How Trolley Payouts Work

A typical trolley payouts lifecycle includes four integrated components:

1. Recipient Onboarding

Recipients securely provide:

- Bank account details

- Preferred currency

- Tax documentation (W-8, W-9)

- Identity verification information

Automated onboarding helps ensure accuracy and reduces processing delays.

2. Compliance & Risk Controls

4

Before payments are executed, systems may perform:

- Sanctions list screening

- Anti-money laundering checks

- Fraud detection monitoring

- Audit logging

Compliance automation reduces exposure to regulatory penalties.

3. Global Payment Execution

Supported payout rails commonly include:

- ACH (United States)

- SEPA (European Union)

- SWIFT (International transfers)

- Local bank transfer networks

- Multi-currency settlements

Businesses can initiate:

- Bulk payout batches

- Recurring scheduled disbursements

- API-triggered transfers

- Manual dashboard payments

Automation ensures consistent payout cycles.

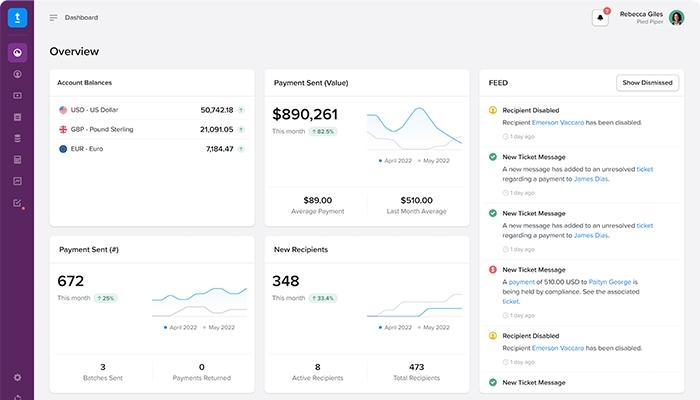

4. Reporting & Reconciliation

Operational oversight tools often provide:

- Real-time transaction tracking

- Error and rejection alerts

- Exportable financial reports

- Year-end tax summaries

This improves financial transparency and simplifies reconciliation.

Multi-Currency & Cross-Border Optimization

4

International disbursements require management of:

- Currency exchange fluctuations

- Regional compliance requirements

- Settlement timelines

- Foreign exchange transparency

Trolley payouts systems typically centralize currency handling and provide visibility across jurisdictions.

Tax Documentation Automation

Tax compliance workflows may include:

- Digital W-9 collection

- W-8 series forms for international recipients

- Tax ID validation

- Annual reporting exports

Embedding documentation directly into payout systems reduces administrative burden.

This content is informational only and does not constitute legal or tax advice.

Security Architecture

Financial infrastructure requires strong security standards. Trolley payouts systems generally implement:

- Encrypted data storage

- Secure API authentication

- Role-based access controls

- Comprehensive audit trails

- Real-time monitoring alerts

These measures protect sensitive financial information.

Who Uses Trolley Payouts?

Common users include:

- Online marketplaces

- Creator monetization platforms

- Affiliate marketing networks

- Gig economy services

- SaaS platforms

- Fintech startups

Any organization distributing funds at scale may benefit from trolley payouts infrastructure.